ATTENTION: For Those who are serious about Getting Pre-Qualified FAST!

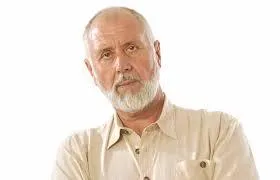

Bill Rapp, Mortgage Originator: NMLS 228246

"Brokers Are Better.

Better Pricing, Better Service!"

Subscribe To My List Below To Get Your Mortgage Quote Now!

Simply enter your name and email below:

WITH PROVEN STRATEGIES & PROVEN RESULTS

HERE'S WHAT MY CLIENTS SAY:

What People Are Saying:

Excellent Service

Bill is an exceptional loan officer. He helped us to purchase our home with very personal and professional service. He helped us navigate the whole process from start to closing without any problems. We didn't think we're qualified to purchase a house, but Bill went above and beyond to find a way to help us achieve our goal. He always responded very quickly with our requests, he would come back with different options with comparison chart to clearly indicate how much we need for down payment, monthly payments, interest rates, closing costs etc.

We would highly recommend Bill to anyone in need of lending services. In fact, we have already recommended Bill to one of our friends on purchasing a house.

--- David Chan - Houston, TX

Bank Statement Lending!

William Rapp of Network Funding, L. P. was very professional and I felt comfortable in dealing with him. I will definitely recommend him to family and friends.

--- Ian F - Missouri City, TX

Professionalism - Expert In Home Style Loan

Bill is an expert in the topic, his explanations and online material make a difference and he is always there from the beginning to the end. He is committed to make thing happen.

--- Felipe Caldern & Carolina Angel Gutierrez

Great Service!

Bill Rapp's handling of our loan (even though out of state) was unparalleled to any service I have been through prior, including 3 different real estate transactions and multiple refinances. Extremely quick close, with great options and flexibility for my families needs. All around A+

--- Chris & Beth Sheehan - San Jose, CA

Knowledgeable and Responsive!

Bill was a pleasure to work with and he made the loan process fairly easy. He answered all questions I had very quickly and was straight forward in doing it. I would recommend Bill to others.

--- Wes Brady - Richmond, TX

Very professional and always returned our calls!

Bill takes a lot of pride in his job and is very dependable. They were very patient and understanding. He went out of his way and explained all my questions and concerns. They were very professional and returned my phone calls and emails. He did a great job and I fully recommend him.

--- Therese, Malcom & Shirley Teixeira - Katy, TX

Great Job!

Bill helped us out from beginning to end of loan process. The loan closed in a timely manner as Bill worked hard with bank to get our to the final steps.

--- Kamal & Theresa Wilson - Hartford, CT

Avid Problem-Solver and Absolute Pleasure to Work With!

Bill Rapp worked very hard to ensure that we closed our loan and were able to move into our new home. He always had alternatives to any problems we encountered while closing. He worked with us from the beginning identifying solutions to any problems that we were having. He was an absolute pleasure to work with!

--- Nikita Rayani & Sanit Tejani - Houston, TX

Awesome to work with!

Being a first-time buyer I came in with lots of questions and concerns. Bill was always available for any questions I had and answered everything to my satisfaction. Bill made the loan process so painless that I could still concentrate on other things. We ended up closing early which made things even better. If you are in need of a lender and want someone who is very approachable and stays on top of your loan then Bill is your guy.

--- Cesar Raya - Richmond, TX

Loan Declined by my bank, and he saved the day!

Bill, did an amazing job helping me close on my house. He took the reigns and reassured me the best route to take to help close. He was accountable, thorough and trustworthy. I will continue to work with Network Funding, L.P. when it comes to home buying in the future because of the quality of service Bill gave.

--- Jacob Smith - Boerne, TX

Bill Rapp Will Definitely Make It Happen!

Bill is the most kind, patient and helpful person I have ever known. He answers his phone calls and emails promptly. You can ask him a million questions, and he will answer each and every one of them. Before I started working with Bill, I had been turned down for a home loan, because of some past credit issues I had, plus I was a single mother. However, once I started working with Bill, he was able to quickly get me a home loan, with a good interest rate. I would recommend that you call him, as he will help you.

--- Corinne Wilson - Roselle, NJ

Knowledgeable, Honest, Trustworthy, and Reliable!

"I will definitely keep you in mind. If anyone I know needs financing, I will send them your way!"

--- Jon & Andrea Saleem, CRPC Financial Advisor - Houston, TX

Best Dam Mortgage Guy a man could know!

"Hands down the best loan experience to date!"

--- Gabe & Chelsea Jackson - Pearland, TX

Phenomenal, Hard Working and Never Quits!

Had a stupid foreclosure that could have been avoided if ex’s attny would have sent my buy out offer. So Bill was able to push this through with a 4 year foreclosure. He worked his butt off, was very diligent with his communication; and was very professional talking to me even when I was screaming and/or crying at him. Highly recommend this lender. He really go to the ends of the earth to help you!

--- Liz Keeter - Harlingen, TX

Exceptional customer service!

Bill is the most kind, patient and helpful person I have ever known. He answers his phone calls and emails promptly. You can ask him a million questions, and he will answer each and every one of them. Before I started working with Bill, I had been turned down for a home loan, because of some past credit issues I had, plus I was a single mother. However, once I started working with Bill, he was able to quickly get me a home loan, with a good interest rate. I would recommend that you call him, as he will help you.

--- Isha Lopez & Mauricio Garcia - Houston, TX

Service with a capitol S

Bill went above and beyond at every turn. He worked late on Saturday, he worked late all the time. We wanted to close ASAP and he really helped make it happen for us.

--- Jeff & Wendy Heger - Houston, TX

Best Buying Experience!

I would would highly recommend going with Network Funding LP. As a first time home buyer I didn't know what to expect. Bill Rapp was very helpful in answering all my questions and guided me through all ghe steps. I couldn't have asked for a better buying experience!

--- Tabitha Turner - Humble, TX

Would recommend him and use him again!

Very involved and professional . Kept me informed and up to date on everything that was going on Went with me closing and was very helpful and knowledgeable.

--- Kathy Ward - Houston, TX

Great experience!

Well I meet bill back in December 2016 he got recommended by my real estate agent we had a house in sight and started the process to get approved but we fail due to my work history and credit bill told me not to give up and put me in contact with a credit repair company they help me bring my score up and bill walk me thru the process of getting a new line so this time around we got approved before looking for our house after we found it we still had a couple of hick up but with bills help on Sunday 6-18-17 to be exact Father's Day bill called me to give me the great news that we had got approved and the closing date was as scheduled bill was more than just a lender to my family he became a friend and I'm alway going to have him in mind for any other financial situation.

--- Alejandres Felimon - Richmond, TX

I really liked his attitude!

I wouldn't usually say this but the way he had handled my mortgage was really pleasant. I personally enjoyed the time spent with him while we discussed feasible rates. He's a great man with a great personality and he offered really low interests as well. Definitely recommend him to others.

--- Tom Troiano - Atlantic City, NJ

He's nothing short of a miracle!

I'm a self-employed businessman and had him figure out the mortgage of the house after 30% down payment. The interest rates I received were incredibly low given what I had thought of earlier. One other important thing to note was that I hadn't really taken any loans earlier, so I had no credit history. He helped me out with all that as well so I can't really call him anything else but a miracle.

--- Fran Suarez - Cleveland, OH

He's really helpful!

I made a bid to him and the very same day he gave me an offer which I couldn't resist. It was too intimidating with those incredibly low interest rates and all, thoroughly recommend him.

--- Kenny Mickle - Houston, TX

Expeditious!

Bill was very expeditious and made it real easy going through the loan process. I felt he was on top of things.

I deal with investment properties and will more than likely call on him again.

--- Wayne King - Pensacola, FL

Bill was great!

Bill made us feel like a friend all the way thru the process. He was patient and explained everything he needed clearly. He was available ANYTIME we had questions or needed more information. Hopefully we won’t go thru this process again anytime soon, but if we do - we’d choose Bill! =)

--- Barbra & Nick Grimmer - Austin, TX

Great broker!

Bill was a great broker to work with. As first time home buyers we had many questions about the process, Bill took the time to help us even calling us back on weekends with answers. I would not hesitate to recommend him to anyone looking for a broker to work with.

--- Murray & Lisa Turner - Pensacola, FL

Outstanding service!

I couldn't have been more pleased with Bill's level of service. He made what is typically a lengthy, arduous process far quicker and easier at every turn. I'm extremely comfortable recommending Bill to friends and family, and will definitely utilize his services again!

--- Jim Lipari - Austin, TX

Commercial Lending Made Simple

Commercial real estate financing is one of the most powerful tools available to business owners. Unlike many other forms of business credit—often short-term and higher cost—commercial mortgage loans provide long-term, asset-based financing with competitive interest rates, predictable repayment structures, and favorable tax treatment. When structured correctly, commercial lending allows companies to acquire property, manage risk, and preserve liquidity.

In the United States, commercial lenders primarily extend credit secured by hard collateral. Most commonly, that collateral is real estate, though it may also include non-conforming assets, receivables (factoring), or other approved collateral sources. A commercial mortgage is a loan secured by income-producing or business-use property, such as office buildings, retail centers, industrial warehouses, or apartment complexes. Loan proceeds are typically used to purchase, refinance, or redevelop commercial property.

Commercial mortgages are tailored to align the needs of both borrower and lender. Key terms include loan amount, interest rate, maturity, amortization schedule, and prepayment flexibility. Because of the size and complexity of these transactions, commercial loans are subject to rigorous underwriting and due diligence. Lenders evaluate both the property and the ownership group (the “sponsor”), and often require third-party reports such as appraisals, environmental reviews, and engineering assessments prior to closing.

Commercial lenders place significant emphasis on the type, quality, and equity position of the underlying collateral. While these loans often provide greater flexibility than traditional bank financing, that flexibility can come at a higher cost—particularly with bridge loans, where speed and execution certainty justify higher interest rates. Many borrowers accept this tradeoff to secure fast funding or accommodate non-standard deal structures.

Because commercial lenders operate with less regulatory constraint than traditional banks, the industry is known for speed and responsiveness, making it an attractive option for borrowers seeking timely capital solutions.

Understanding Commercial Real Estate Financing

For first-time borrowers, commercial real estate financing can appear intimidating. Commercial mortgages differ substantially from residential loans in complexity, underwriting standards, and cost. However, understanding the fundamentals before applying can eliminate uncertainty and help borrowers approach the process with confidence.

At its core, commercial real estate financing mirrors residential lending: real property is pledged as collateral to purchase or refinance a property. Businesses may also borrow against existing equity, either as a lump-sum loan or a revolving line of credit, for a wide range of business purposes.

Commercial mortgage loans generally require regular payments of principal and interest and may carry either fixed or variable rates. Throughout the loan term, the lender maintains a security interest in the property and retains the right to foreclose in the event of default, just as a residential lender would.

The key distinction lies in the nature of the borrower and the property. Residential mortgages are designed for individuals and one-to-four-unit properties. Commercial mortgages, by contrast, are structured for business entities—both for-profit and nonprofit—and apply to retail, office, industrial, multifamily (five or more units), and other commercially zoned properties.

Due to limited marketability and higher default risk, commercial real estate loans are viewed as higher risk than residential mortgages. If a lender must foreclose, selling a commercial asset is typically far more complex than selling a home. As a result, commercial lenders impose more conservative underwriting standards, higher down payment requirements, shorter loan terms (often capped at 20–30 years), and higher interest rates.

While lenders prefer financially established businesses, newer companies or those with limited operating history may still qualify through personal guarantees from one or more principals. These guarantees help offset perceived risk and improve loan approval odds.

Commercial loans are also more expensive to process and close. Loan sizes are larger, and nearly every aspect of due diligence—valuation, title, underwriting, and legal review—is more detailed and therefore more costly than in residential lending.

A “Vanilla” Commercial Mortgage: Key Components

While commercial loans vary widely, a standard or “vanilla” commercial mortgage typically includes the following elements:

Debt Service Coverage Ratio (DSCR)

Commercial lending is primarily income-driven. Lenders focus on the property’s ability to generate sufficient cash flow to cover debt obligations. Most lenders require a DSCR between 1.20 and 1.25. For example, if the monthly mortgage payment is $2,000, the property should generate $2,400–$2,500 in net operating income after expenses.

Down Payment

Borrowers are generally required to contribute 20–25% equity at closing (as low as 10% for certain SBA programs). Higher-risk properties or borrowers with limited operating history may face increased equity requirements.

Prepayment Penalties

Commercial loans often include declining prepayment penalties, such as 5% in year one, 4% in year two, and so on, typically disappearing after year five. These penalties are a critical consideration for borrowers who may sell or refinance before the penalty period expires.

While these terms represent a standard structure, many lenders allow flexibility. Adjustments to one term often require concessions elsewhere—such as a higher interest rate, upfront fee, or personal guarantee—to balance risk.

Where to Obtain Commercial Real Estate Financing

Commercial mortgage financing is widely available throughout the United States. Common sources include:

Commercial mortgage brokers

CMBS (Commercial Mortgage-Backed Securities) lenders

Regional and community banks

Private equity sources, including life insurance companies and pension funds

Specialty finance companies, including conduit and hard money lenders

Most business owners work with commercial mortgage brokers because brokers can evaluate multiple lenders and structure options efficiently. Banks may limit lending by property type or industry and often require extensive documentation. Brokers streamline this process by identifying suitable programs and negotiating competitive terms.

Conduit and hard money lenders offer faster closings and reduced documentation requirements, making them attractive for time-sensitive deals. Their flexibility, however, comes at a higher cost, with interest rates exceeding those of traditional banks.

For larger or more complex projects, private equity firms may provide mezzanine loans or equity capital to fill funding gaps beyond what senior lenders will provide—typically above 75–83% loan-to-cost. While highly flexible, these sources demand higher returns and should be approached strategically.

Commercial mortgage brokers do not fund loans directly. Instead, they analyze borrower needs, package the transaction, and match it with the most appropriate lender. A skilled broker brings market knowledge, lender relationships, and execution certainty—saving borrowers time, stress, and costly missteps.

Preparation: The Key to a Smooth Closing

Advance preparation is essential in commercial lending. Unlike residential loans, meaningful rate and term discussions cannot occur without detailed financial information. Lenders will typically request:

Property details (purchase contract or offering memorandum)

Two years of income and expense statements

Current rent roll

Personal financial statement

Two years of personal and business tax returns

Recent asset statements (bank, brokerage, or retirement accounts)

Providing complete and accurate information upfront improves pricing accuracy and reduces the risk of unpleasant surprises later. Borrowers should be cautious of lenders who quote terms without reviewing this documentation.

Call Bill Rapp, the Mortgage Viking, today to discuss your commercial financing options and secure the right capital structure for your next acquisition or refinance.

📈 2026 CRE Buying Activity Is Back — Why Disciplined Investors Are Re-Entering the Market

📈 2026 CRE Buying Activity Is Back — Why Disciplined Investors Are Re-Entering the Market

🏢 Commercial Real Estate in 2026: More Buyers, Smarter Leverage, Better Deals

2026 to See Increased CRE Buying Activity: A Disciplined Reset, Not a Speculative Boom

Commercial real estate is entering a new phase in 2026—and the signal is clear: investors are buying again. But this cycle looks very different from the excess-driven expansion of the past decade. Today’s activity is defined by pricing discipline, conservative leverage, and durable cash flow, not aggressive assumptions.

For borrowers, developers, and investors, this environment creates opportunity—but only if capital is structured correctly.

Investor Confidence Is Rebuilding

After several years of rate volatility and stalled transactions, confidence is returning. Nearly 95% of investors plan to acquire the same or more assets in 2026, while 55% are increasing capital allocations to real estate, a meaningful jump from last year.

What’s driving the shift?

·Stabilizing interest rates

·Narrowing bid-ask spreads

·Underwriting assumptions that finally pencil again

In short, the math is working again—but only for deals with sound fundamentals.

Capital Is Moving—Selectively

This is not a “buy everything” market. Capital is flowing to well-located, income-producing assets where pricing has adjusted and downside risk is understood.

From a financing standpoint, this favors borrowers who:

·Present realistic rent growth assumptions

·Structure conservative leverage

·Focus on long-term hold strategies

Lenders are active—but they are rewarding preparation and discipline.

Where Investors Are Buying in 2026

Geographically, investor demand remains concentrated in high-growth, liquid markets.

·Dallas–Fort Worth remains the top U.S. market for the fifth straight year

·Atlanta continues to attract capital due to population and job growth

·San Francisco is re-emerging as a selective recovery play

·Charlotte and Tampa reinforce the strength of Sun Belt fundamentals

These markets offer liquidity, demographic tailwinds, and lender comfort—critical factors in today’s credit environment.

Sector Preferences: Back to Fundamentals

Investor interest in 2026 is anchored in traditional property types with clear cash-flow visibility:

·Multifamily remains the top sector

·Industrial continues to benefit from reshoring and logistics demand

·Retail attracts capital where tenant mix and pricing are right

·Office is still limited—but selectively returning for Class A assets in prime locations

Alternative assets remain niche, as most investors prefer repriced core sectors with proven demand.

Risk Appetite Is Measured, Not Aggressive

Roughly two-thirds of investors are targeting value-add and core-plus strategies—seeking stable income with controlled upside.

Opportunistic and distressed strategies are fading as:

·Widespread fire-sale pricing fails to materialize

·Lenders avoid forced liquidations

·Owners with strong balance sheets hold assets longer

This favors borrowers who can execute business plans without relying on heroic assumptions.

Conservative Leverage Is the New Normal

From a capital markets perspective, leverage discipline defines 2026:

·Most investors are holding debt ratios steady

·Nearly half are willing to accept short-term negative leverage

·The bet is on rent growth and refinancing—not yield compression

This creates strong demand for structured debt, flexible terms, and lender diversification—areas where mortgage brokers add significant value.

Bottom Line

2026 marks a return to buying—not a return to excess.

Commercial real estate investors are re-entering the market with confidence grounded in:

·Improved pricing

·Disciplined leverage

·Long-term fundamentals

For borrowers and investors, success in this cycle depends less on timing the market—and more on structuring capital correctly from day one.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://buymeacoffee.com/vikingente3

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

Main Office:

Medallion Funds

[email protected]

11920 Southern Highlands PKWY Suite 302Las Vegas, NV 89141

Texas Complaint and Recovery Fund Notice

All Rights Reserved Copyright © 2021 - Bill Rapp The Mortgage Viking | NMLS #228246